Liquidity Pool Farming on Fogo for Beginners

Jan 19, 2026

Real quick: If you haven't joined Fogo's Season 2 Airdrop yet, start here. Now let's continue.

Liquidity pools can pay you on every trade, but only if your capital is placed in the right range.

This is a short guide on how to earn passive income by providing liquidity on Valiant Trade.

What Are Liquidity Pools?

Liquidity pools are where you deposit your tokens (like FOGO and USDC) into a platform. In return, you earn a share of the trading fees generated every time someone swaps tokens. On Valiant, traders pay a fee per swap, and that fee gets distributed to liquidity providers.

Before diving in, make sure you understand impermanent loss. We have a separate tutorial explaining this concept, and it's essential knowledge before providing liquidity.

Getting Started

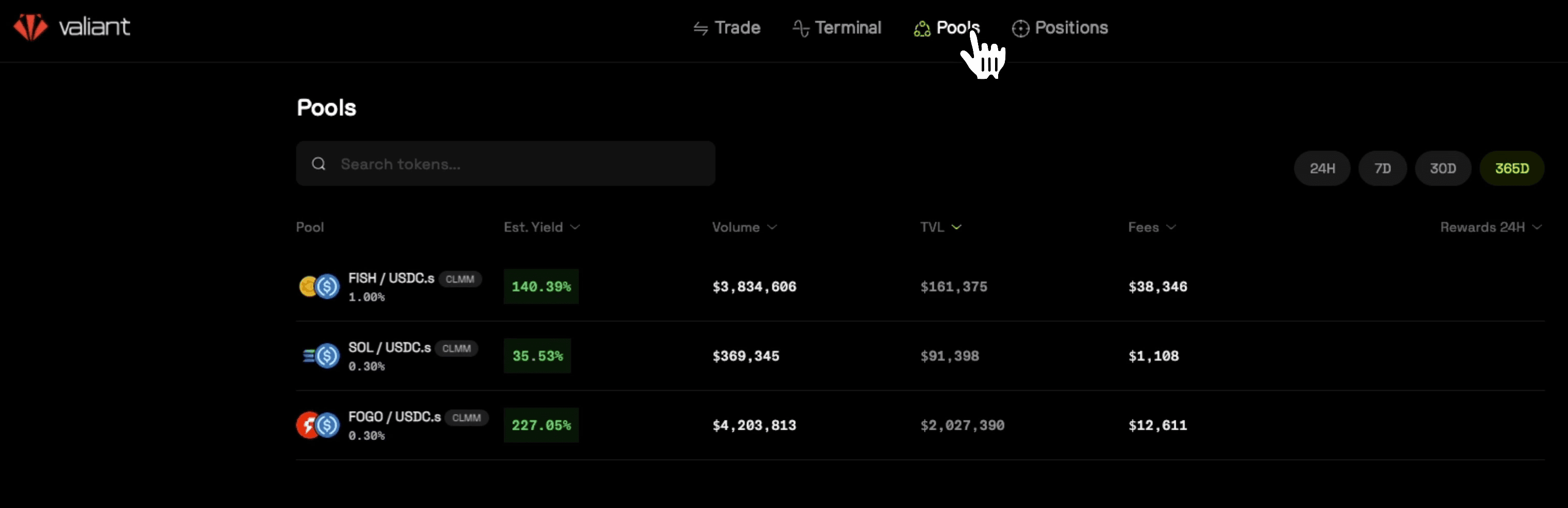

Head to valiant.trade and click on Pools. You'll see available liquidity pools with key metrics:

Volume: How much trading activity the pool has seen

TVL: Total value locked in the pool

Fees: How much has been generated in trading fees

Estimated Yield: The projected annual return based on current activity

These yields are dynamic and will fluctuate based on trading volume and the amount of liquidity in the pool.

The Simple Approach: Full Range Liquidity

The easiest way to provide liquidity is using the default settings. Select a pool (e.g., FOGO/USDC), enter an amount, and deposit. This creates a position across the entire price range, meaning you'll earn fees no matter where the price goes.

The downside? Your capital isn't being used efficiently. You're providing liquidity at prices that may never be reached, which dilutes your fee earnings.

The Better Approach: Concentrated Liquidity

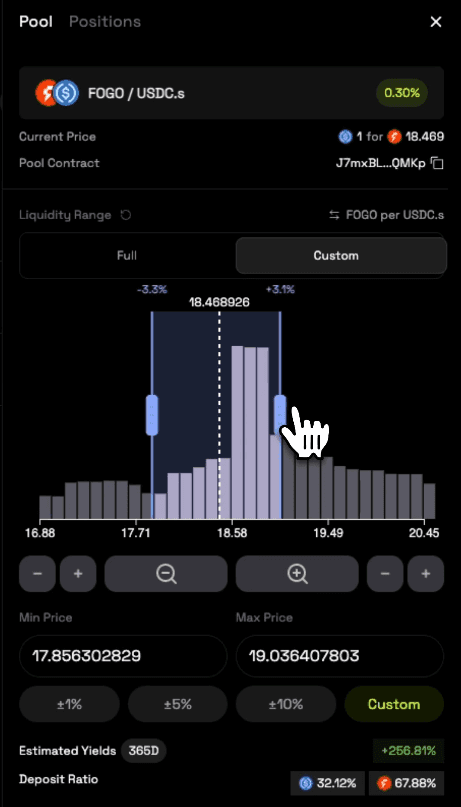

For better returns, use a custom range. Click on the pool, then select Custom. This lets you define a specific price range where you want to provide liquidity.

The narrower your range, the more fees you earn when the price stays within it. But if the price moves outside your range, you stop earning fees entirely.

How to Choose Your Range

This is where strategy comes in. You want to predict where the price will trade and concentrate your liquidity there.

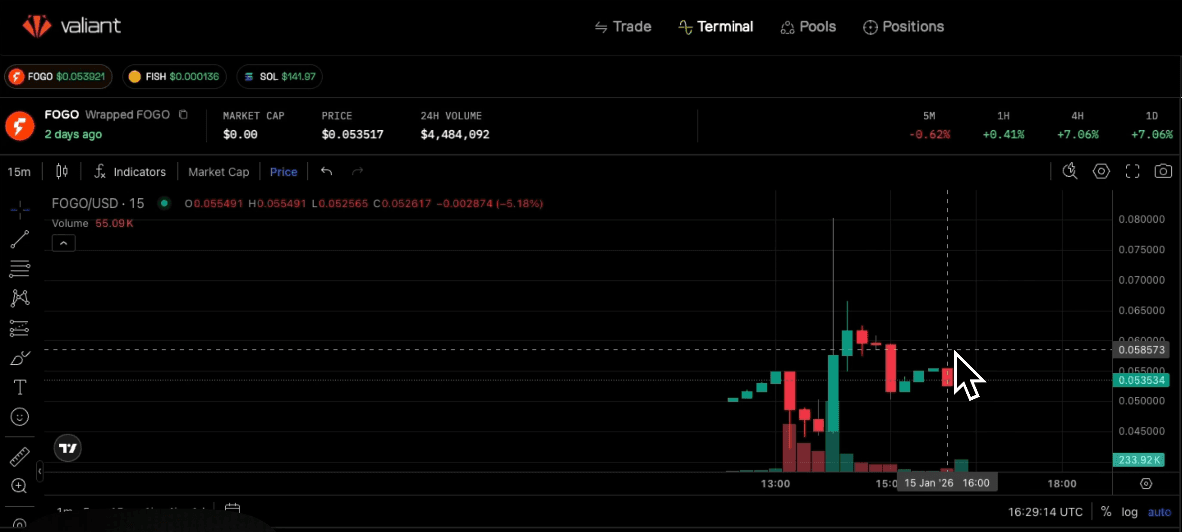

Use the Terminal feature on Valiant or check TradingView to analyze historical price data. Look for:

Recent trading ranges

Support and resistance levels

How volatile the token has been

For a new token like FOGO with limited history, you might set a wider range (e.g., 20% down and 20% up from current price) until more data is available. For established tokens, you can analyze months of price action to identify likely ranges.

Setting Up a Custom Position

Go to Pools and select your pair

Click Custom

Click the toggle to view prices in a readable format

Adjust the sliders to set your minimum and maximum price

Enter your deposit amount

Click Deposit

You can create multiple positions with different ranges. For example, a tight range for maximum efficiency plus a broader range as a safety net.

Understanding Your Position

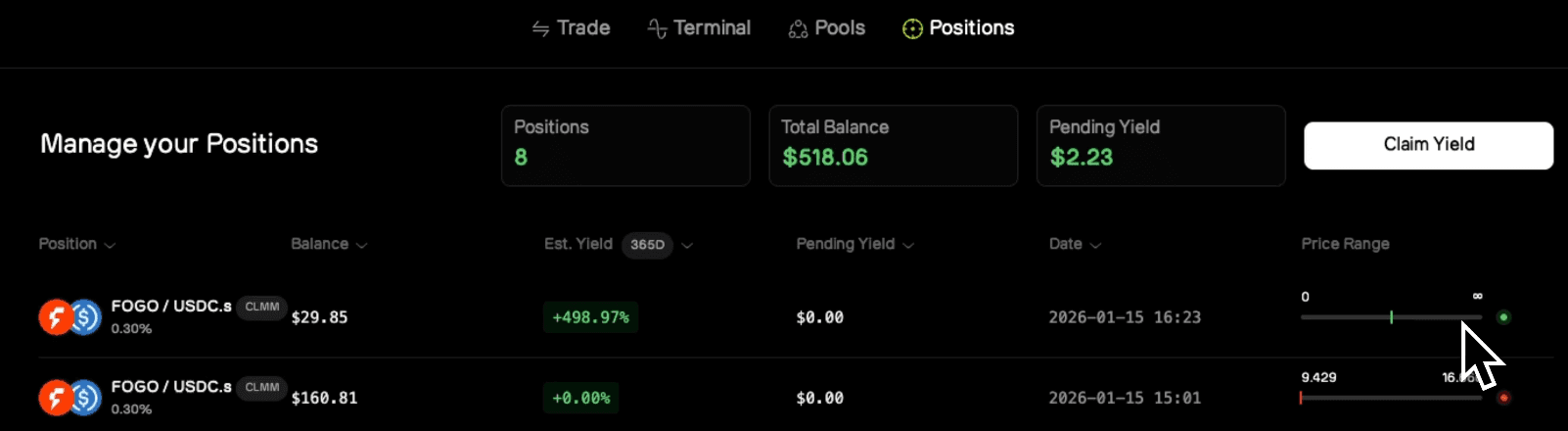

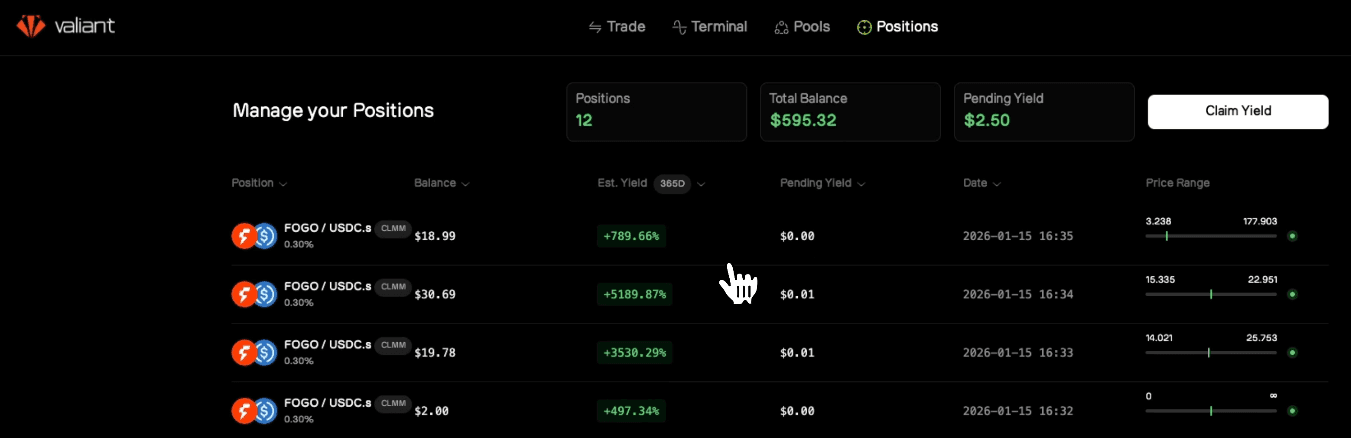

After depositing, go to Positions to view your liquidity. It will show:

Your current price range

Whether you're in range (earning fees) or out of range

Pending yield to claim

A visual representation of your position

Click the toggle to see a graphical view of your range relative to the current price. Green means you're in range and earning fees. Red means you're out of range.

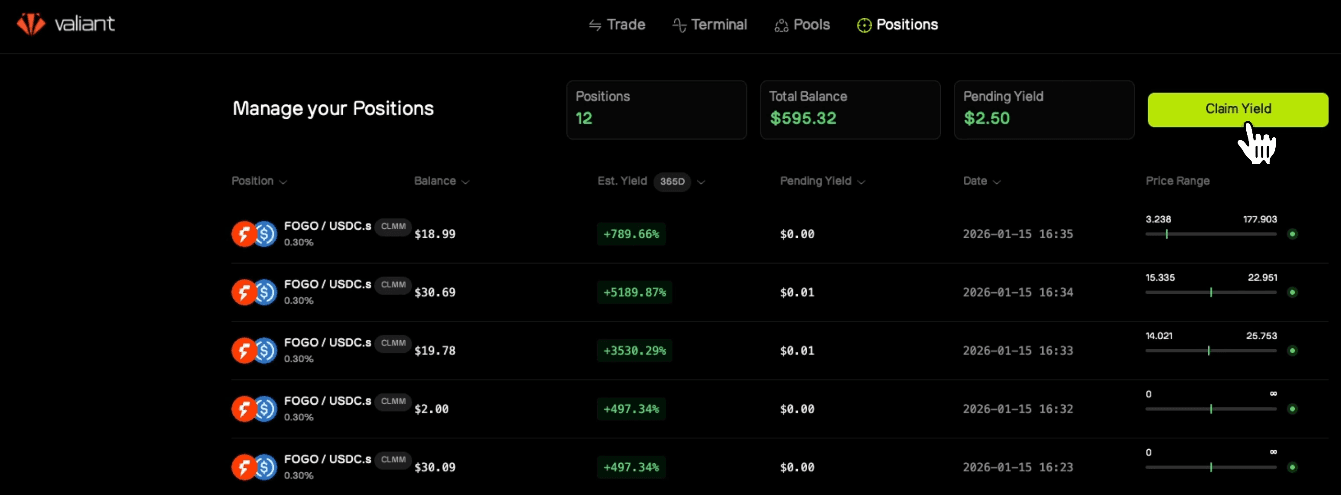

Claiming Your Fees

When you've accumulated yield, click Claim Yield to harvest your earnings. You can then reinvest those fees, create new positions, or swap them for other tokens.

Key Considerations

Capital Efficiency: The tighter your range, the more fees you earn per dollar deposited, but you risk going out of range more often.

Impermanent Loss: If the price moves significantly, you may end up with less value than if you'd simply held the tokens. Your goal is to earn more in fees than you lose to impermanent loss.

Active Management: Concentrated liquidity positions may need adjustments as prices move. Monitor your positions and rebalance when necessary.

Start Small: If you're new to liquidity providing, start with a small amount to learn how it works before committing more capital.

Help us on our mission

If this information was useful, you can support us by staking with our validator. Earn yield while helping us produce more content like this for the community.

And… don’t miss Season 2 Airdrop. Sign up here and start earning flames.

Want a visual walkthrough? The video below covers this topic in detail.

Need Help with Fogo?

We've created a library of different tutorials on navigating the Fogo blockchain. Be sure to check out our blog posts for more.

In addition, we have a YouTube playlist showing this tutorial and many others.

Disclaimer: This content is for educational purposes only and is not financial advice. Always do your own research before making any investment decisions.