Impermanent Loss for Beginners

Jan 20, 2026

Want in on Fogo's Season 2 Airdrop? Sign up here before you begin reading.

Liquidity pools pay fees, but if price moves the “wrong” way, you can still lose money even while earning yield.

This is a short guide explaining impermanent loss and why understanding it is essential before you start earning yield through liquidity pools.

What Are Liquidity Pools?

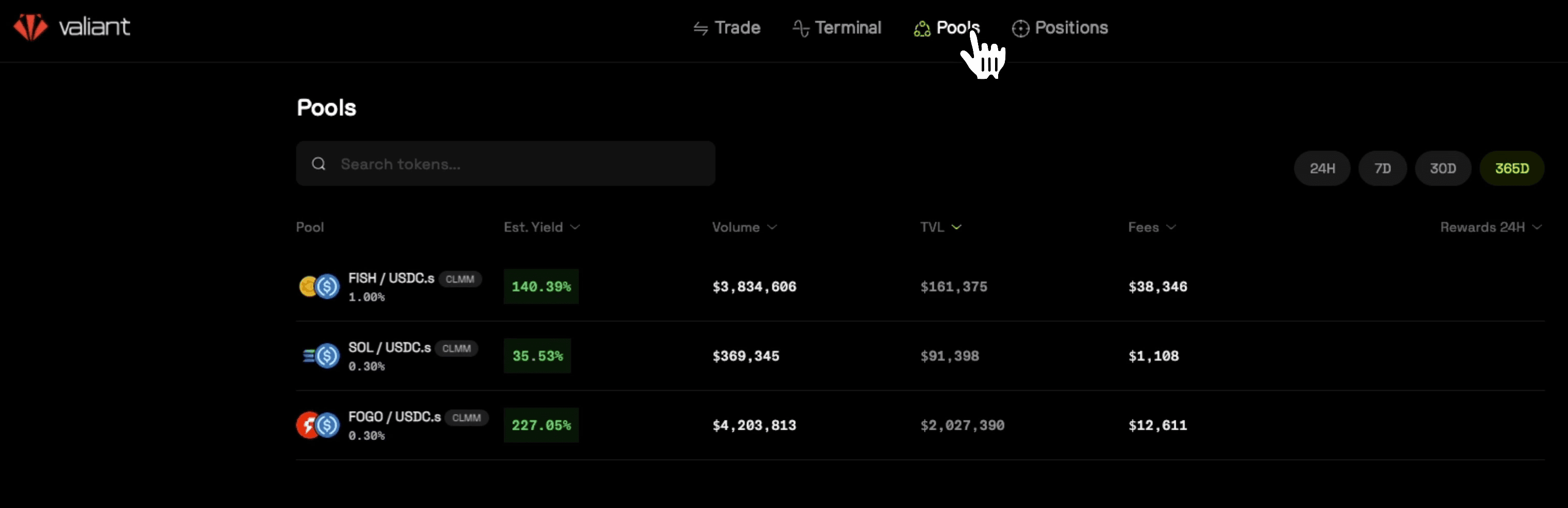

On platforms like Valiant, liquidity pools hold two different assets (e.g., FOGO and USDC). When traders swap between these tokens, they pay a fee, and that fee goes to the people who provided the liquidity. Sounds great, right? It can be, but there's a catch called impermanent loss.

What is Impermanent Loss?

Impermanent loss (also called divergence loss) occurs when the price of one token in your liquidity position changes significantly compared to when you deposited.

Here's how it works: when you provide liquidity, you're essentially agreeing to let the pool automatically buy and sell tokens as the price moves. If FOGO goes up, the pool sells your FOGO for USDC. If FOGO goes down, the pool buys more FOGO with your USDC.

The problem? If FOGO suddenly doubles in price, you would have been better off simply holding your tokens instead of providing liquidity. The fees you earned won't make up for the gains you missed.

A Simple Example

Imagine you deposit FOGO and USDC into a liquidity pool when FOGO is at $5. If FOGO stays between $4.75 and $5.25 for a while, you'll likely do well, earning fees on every trade while the price bounces around your range.

But if FOGO suddenly jumps to $10, your pool position will have sold most of your FOGO along the way. You'll end up with mostly USDC and very little FOGO. Even though your position has some profit, you would have made more money just holding the original tokens.

That difference is impermanent loss.

Why is it Called "Impermanent"?

The name is a bit misleading. It's called impermanent because theoretically, if the price returns to your entry point, the loss disappears. In practice, once you withdraw from the pool, the loss becomes very real and very permanent.

The Goal: Outperform Impermanent Loss

The primary goal of providing liquidity is to earn more in trading fees than you lose to impermanent loss. If you can't do that consistently, you're likely better off simply staking your tokens with a validator instead.

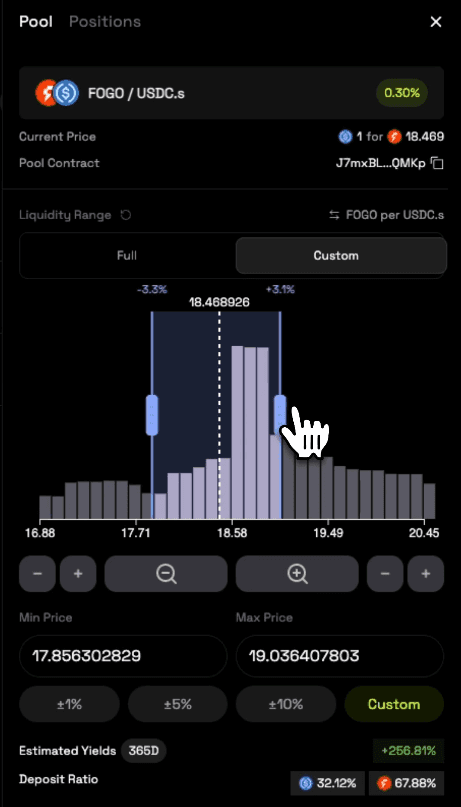

This is why choosing the right price range matters. If you expect a token to trade sideways within a certain band, concentrated liquidity in that range can be very profitable. If the price breaks out dramatically in either direction, you'll likely experience significant impermanent loss.

Is Liquidity Providing Worth It?

When done well, providing liquidity can be one of the most profitable strategies in DeFi. But it requires skill, understanding price ranges, managing positions actively, and accepting that losses are part of the game.

If this feels too complex, there's no shame in simply staking your tokens with a validator and earning a predictable yield without the risk of impermanent loss.

Key Takeaways

Impermanent loss is real. Despite the name, it's often permanent once you exit your position.

Price movement is the enemy. The more a token's price diverges from your entry point, the more you lose compared to simply holding.

Fees must outpace losses. High trading volume in your range generates more fees, which helps offset impermanent loss.

Range selection matters. Tighter ranges earn more fees but are riskier if price moves outside them. Wider ranges are safer but less capital efficient.

Start small. If you're new to liquidity providing, begin with a small amount. A few small losses will teach you more than any tutorial.

Help us on our mission

If this information was useful, you can support us by staking with our validator. Earn yield while helping us produce more content like this for the community.

And… don’t miss Season 2 Airdrop. Sign up here and start earning flames.

Want a visual walkthrough? The video below covers this topic in detail.

Need Help with Fogo?

We've created a library of different tutorials on navigating the Fogo blockchain. Be sure to check out our blog posts for more.

In addition, we have a YouTube playlist showing this tutorial and many others.

Disclaimer: This content is for educational purposes only and is not financial advice. Always do your own research before making any investment decisions.