Dollar Cost Averaging | Buying on Fogo for Beginners

Jan 16, 2026

Heads up: Fogo's Season 2 is happening. Get in here before continuing.

Instead of buying all at once, this shows how to accumulate FOGO at lower prices and get paid in fees while you wait.

What is Dollar Cost Averaging (DCA) in DeFi?

Dollar cost averaging means accumulating a token gradually over time, typically at lower prices. On Valiant, you can do this through custom liquidity positions that buy a token as the price drops, all while earning trading fees in the process.

Getting Started

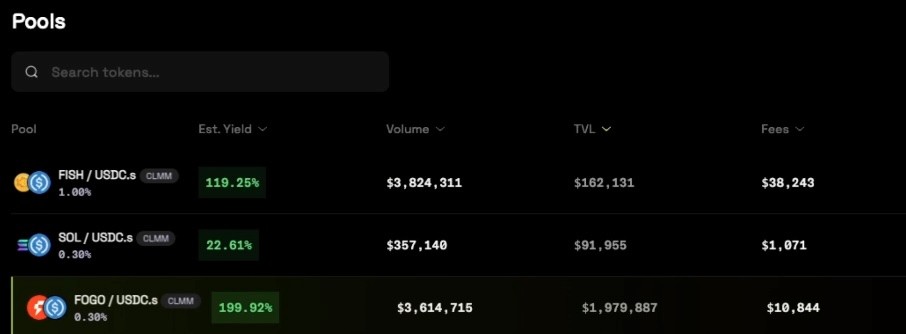

Head to valiant.trade and click on Pools. You'll see various trading pairs with their estimated yearly yields. For this example, we'll use the FOGO/USDC pool.

Setting Up a DCA Position

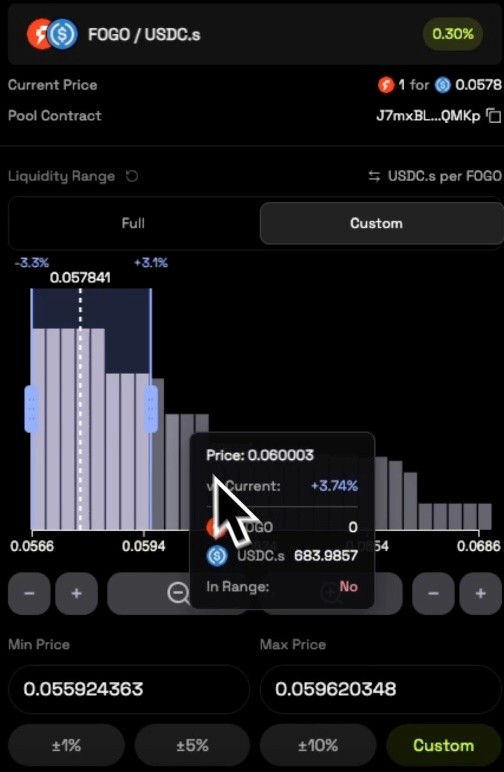

If you simply add liquidity the standard way, it will split your deposit between both tokens. But if you want to accumulate FOGO specifically, you need to use a custom position.

Click on the pool you want (e.g., FOGO/USDC)

Select Custom instead of the standard option

Click the toggle to view prices in your preferred format

Configuring Your Price Range

This is where the strategy comes together. You're setting a price range where you want to accumulate FOGO.

Think about how low you believe the price could go. For example, if you set your range from -1.5% to -19% below the current price, your position will actively buy FOGO as the price moves down through that range.

The key indicator is the deposit ratio. If it shows 100% USDC and 0% FOGO, that means you're depositing only USDC, which will convert to FOGO as the price drops.

How It Works

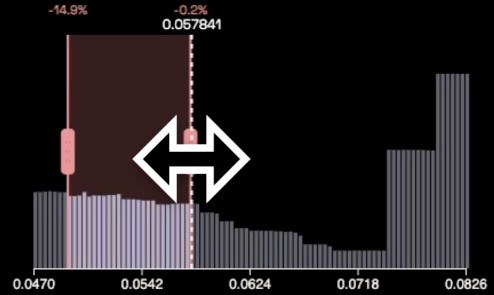

When you deposit (say, 100 USDC), it gets distributed across price "buckets" within your range. As the price moves down:

Your USDC gradually converts to FOGO

You earn trading fees along the way

You accumulate more FOGO at progressively lower prices

If the price stays above your range, you earn no fees but keep your USDC. If it drops below your entire range, you'll have converted to FOGO but won't earn fees until the price moves back into range.

When to Use This Strategy

This approach works well when:

You believe a token will dip but eventually recover

You want to accumulate at lower prices rather than buying all at once

You want to earn trading fees while you wait

Be aware of impermanent loss. If the price drops significantly and doesn't recover, you may end up with tokens worth less than your original deposit.

We have a separate post explaining impermanent loss if you want to understand the risks better.

Managing Your Position

Consider setting a price alert with your portfolio tracker. If FOGO drops to the bottom of your range, you could withdraw everything, collect your accumulated FOGO plus trading fees, and decide what to do next (stake it, hold it, or set up another position).

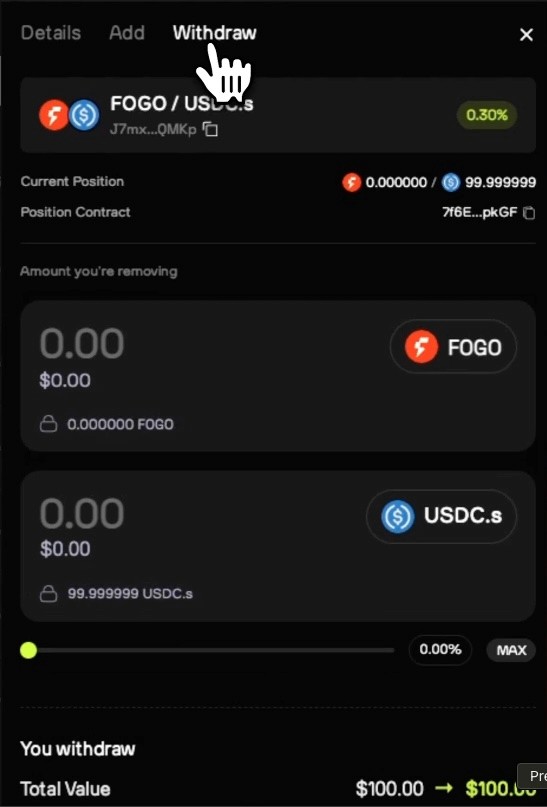

Withdrawing and Claiming Fees

When you're ready to exit:

Click Withdraw on your position

Use the slider to choose how much to withdraw

Click Claim Yield to collect your earned trading fees

Help us on our mission

If this information was useful, you can support us by staking with our validator. Earn yield while helping us produce more content like this for the community.

And… don’t miss Season 2 Airdrop. Sign up here and start earning flames.

Want a visual walkthrough? The video below covers this topic in detail.

Need Help with Fogo?

We've created a library of different tutorials on navigating the Fogo blockchain. Be sure to check out our blog posts for more.

In addition, we have a YouTube playlist showing this tutorial and many others.

Disclaimer: This content is for educational purposes only and is not financial advice. Always do your own research before making any investment decisions.